Information on how this proposed tax cut may affect state and city budgets has been updated since this article was published in August.

The State of South Dakota now projects a loss of over $400 million in the budget.

The City of Brandon, SD now projects a loss of over $550,000.

In 2024, petitioners across the state hope to eliminate grocery taxes throughout South Dakota.

Here’s the short version of the details:

- Dakotans for Health submitted the required number of signatures to the Secretary of State to add an amendment to the state constitution. Voters will weigh in on this issue during the November 2024 election.

- The proposed initiated measured reads: “The state may not tax the sale of anything sold for human consumption, except alcoholic beverages and prepared food. Municipalities may continue to impose such taxes.

The last sentence of this proposed amendment implies that if passed, individual cities may continue to collect sales tax on groceries. This interpretation may be misleading, as South Dakota tax law states “if there is no authority at the state level, there is no authority at the municipal level.” This means without a change by our legislators to the existing tax law, municipalities would not be able to collect this tax under the proposed amendment.

The average family of four in South Dakota spends $1,200 on groceries each month. Taxes on that only add up to $74.40. In a year, the grocery taxes only amount to approximate $895 - much less than the average monthly grocery bill!

Saving almost $900 a year sounds great, but there are tradeoffs to eliminating this tax.

Governor Kristi Noem’s office estimated that removing South Dakota’s sales tax on groceries would result in a loss of $102.4 million in the state budget. South Dakota currently spends every penny allocated in their annual budget, so they would need to make up this lost money to continue operating as usual.

To cover the difference the state could:

- Implement a state income tax.

- Raise property taxes via opt out.

- Reduce or eliminate services and community investments.

Any of these options could result in a significantly higher cost to taxpayers than $895 a year!

If this proposed ballot measure to repeal sales tax on goods for human consumption passes, it will result in a negative impact on the City of Brandon’s departments and services.

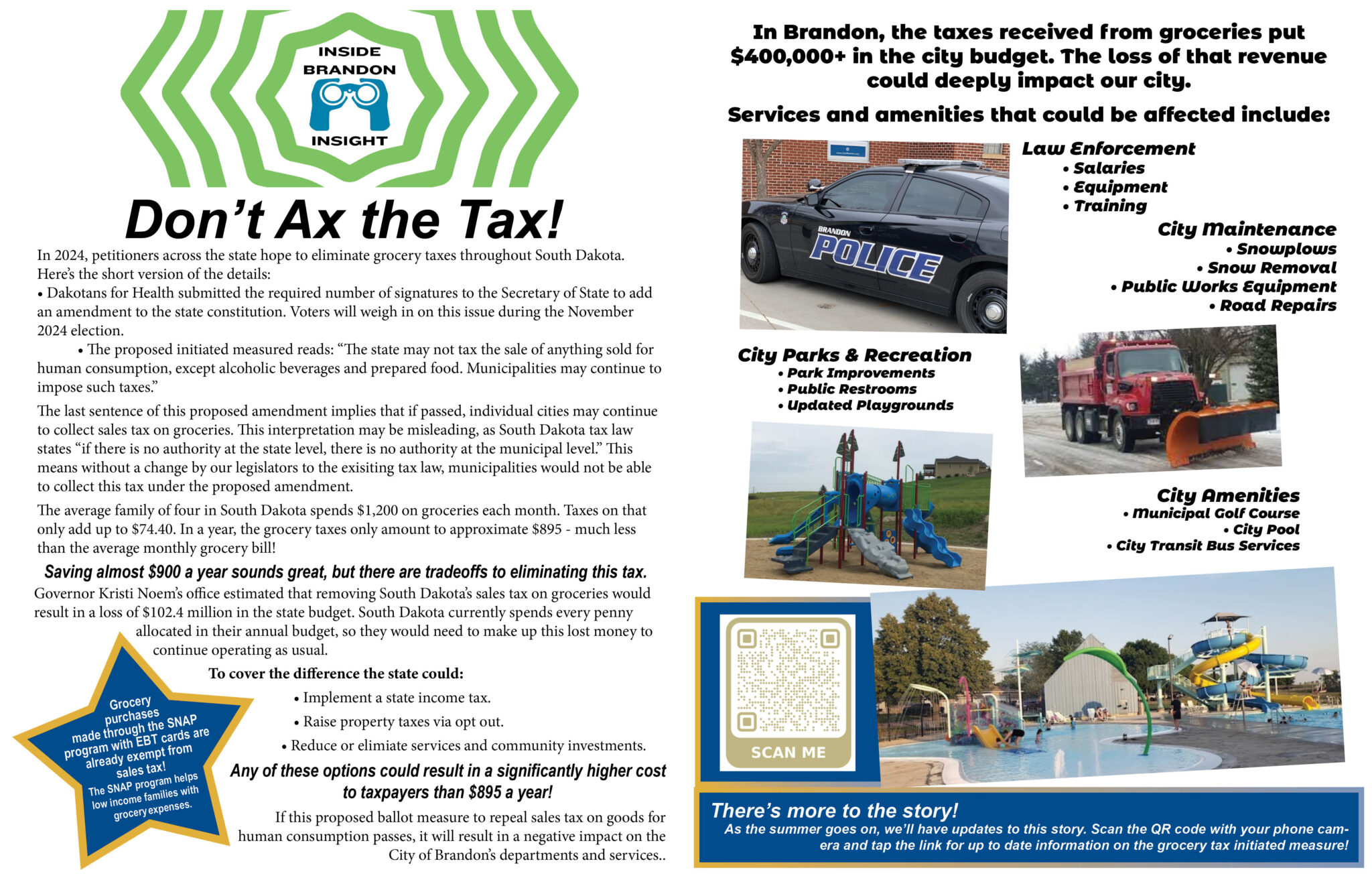

In Brandon, the taxes received from groceries put $400,000+ in the city budget. The loss of that revenue could deeply impact our city.

Services and amenities that could be affected include:

Law Enforcement

- Salaries

- Equipment

- Training

City Maintenance

- Snowplows

- Snow Removal

- Public Works Equipment

- Road Repairs

City Parks & Recreation

- Park Improvements

- Public Restrooms

- Updated Playgrounds

City Amenities

- Municipal Golf Course

- City Pool

- City Transit Bus Services

We'll update this story as we get more details and as things change. Check back for updates monthly!

Last Updated: August 20th, 2024.